Not very many vendors have been discussing the shift in customer profile & sentiment that’s been seen at many dealerships across the country.

It’s better to claim ignorance than to take the blinders off and focus on the facts, which are quite daunting. However, reality is beginning to set fourth in for many family owned independent dealerships. We are going to be facing one of the biggest changes in how we attract buyers, how we advertise to customers, and ultimately what kind of inventory attracts these people into dealership lots.

Since the beginning of the pandemic, into the stimulus program that was rolled out for the sake of helping United states citizens, dealers became awfully comfortable with the fact that customers had more money than they’ve ever had. So asking somebody for 20% or even 30% down on a vehicle became standard practice in the car industry, even with mark-ups, market adjustments, and any other addendum‘s that were added into the total financed price of a vehicle. Lenders also let this slide, due to the recognition of supply constraints, and a limited supply of used vehicles.

This whirlwind of leniency has created some very interesting environments for lenders and dealers alike. Driven by record-breaking gross profits, this had switched the dealer model from working hard and following up with leads to literally taking orders, like a fast food restaurant.

This made our sales teams softer, our pockets lighter, and evidentially dealerships a lot more lazy. Though this would apply to mostly franchise dealerships, many large independents have fallen into these bad habits. Which is why I heed warning to those that are reading this article, and people who recognize these pitfalls and their dealership.

#1: Gross won’t be this high forever.

You know that five pounder you got from that one Internet lead car gurus decide to give you after 7 months with their program?

Prices are beginning to come back to reality, and as the used car market begins to settle into normalcy, so will the front end gross and back end gross dealerships have grown so accustomed to.

Volume is going to be the most important factor in keeping dealers alive during these trying times. For those that aren’t high-volume stores, buying inventory for the right prices will be there objective.

#2: Low money down will become normal.

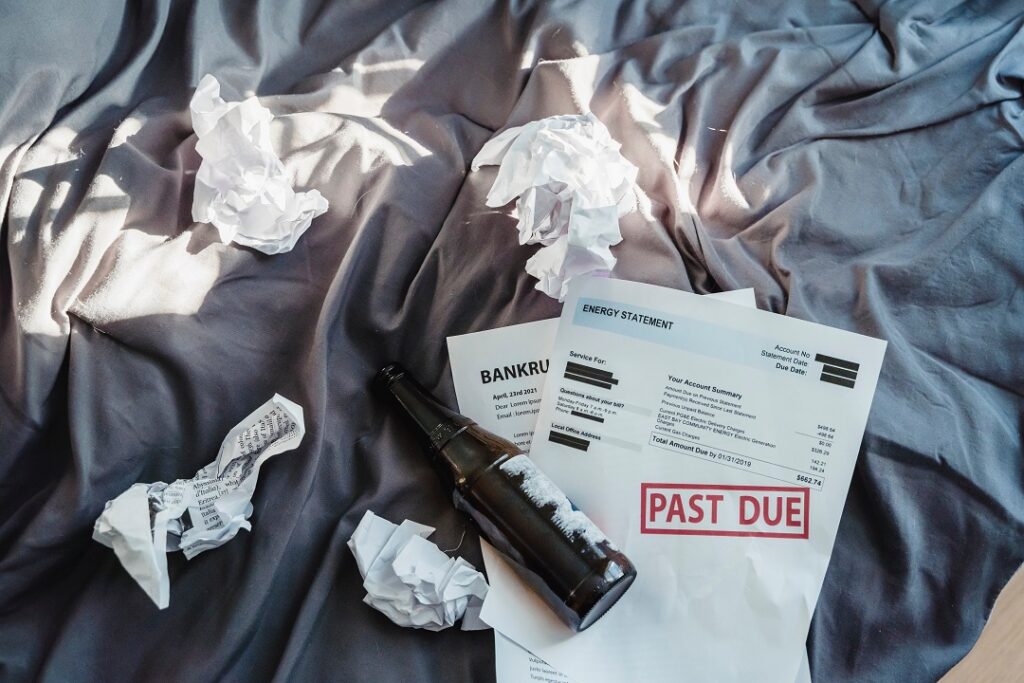

More Americans are defaulting on their loans than ever before. This is due to the normalcy of buying things beyond budget, fueled by stimulus payments. The federal interest rate hikes, followed by tightening restrictions by lenders, will likely change consumer sentiment for years to come.

This is going to create a soft economy where less people are likely to buy a car and those that do may not have adequate money down – or at least the money down we’ve gotten used to over the past two years.

It’s going to take a lot of creative financing to get people into cars the next year. So if you’re not set up with a talented F&I department, you may have a difficult time getting people approved.

#3: Subprime is the new normal.

Dealerships have always wanted prime customers with great income and lots of money down, especially if they’re not set up for buy-here-pay-here financing. And it’s no wonder – these deals are very easy to put together, and usually require a lot less legwork to get done. But there’s a new wave of customer hitting the market, no matter where you turn, you’ll likely be dealing with more credit challenged customers than ever before.

So if you don’t have the right banks, like credit acceptance corp, westlake financial, ally, or any bank that deals with credit challenged customers. You’re likely going to have a difficult time getting a majority of customers into the cars they can afford.

Not to say there won’t be any prime customers, but those that are prime may not be in the market to buy a car until prices adjust more aggressively, or until interest rates fall back to reality.

#4: Prices are still very unreasonable.

If you’re a consumer, or even if you’re a dealer, you understand that our vehicle valuations are still absurd. And though prices have fallen an average of 7% this year alone, It’s not enough to come back to reality for many in-market car buyers.

And because banks aren’t allowing the same LTV’s as before, financing people for these amounts without enough money down or any asset with positive equity to trade in, has become difficult or impossible.

The pricing projections look very promising for the first quarter of 2024, that alone is not enough to be a driving factor in supercharging the new or used car market.

Auto Leads, Subprime Auto

Leads, and VIN Specific Leads for Dealerships.

If you're looking for Auto Leads that purchase, Arbor Advertising is your solution. We specialize in generating REAL customers & lot traffic for Independent & Franchise Dealerships.